DISCLAIMER: This is not meant to be legal advice. The following is intended for educational purposes only. Please consult a licensed attorney for your specific situation.

For reference, here is the PDF version of the bill: WA State HB 1217

When and Why

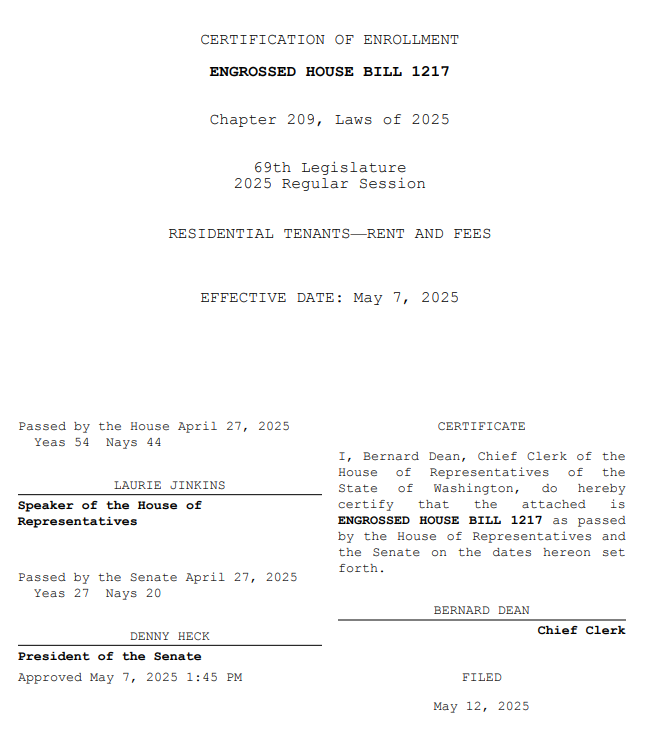

Governor Bob Ferguson signed the bill on May 7, 2025, and it is effective immediately.

It is set to expire on July 1, 2040. Homes that are a manufactured build have a permanent implementation.

The stated goal is to improve housing stability for tenants by:

- Limiting rent and fee increases.

- Requiring notice of rent and fee increases.

- Limiting fees and deposits.

- Establishing a landlord resource center and associated services.

- Authorizing tenant lease termination.

- Creating parity between lease types.

- Providing for attorney general enforcement.

What Changes

There can be no increase in rent during the first 12 months after the tenancy begins.

After first 12 months of tenancy, rent increases can’t exceed 7% plus the consumer price index (CPI), or 10%, whichever is less.

Rent can be adjusted with no restrictions after a tenant vacates the home.

Beginning June 1, 2025, and annually thereafter, the Department of Commerce calculates the maximum annual rent increase allowed for the following calendar year. It will be published on their website and in a press release.

If landlord submits an increase over the Department of Commerce's stated amount.

Then, the landlord must include facts supporting any claimed exemptions in the written notice of the rent increase.

The tenant must offer the landlord an opportunity to cure the unauthorized increase by providing the landlord with a written demand to reduce the increase to an amount that complies.

If landlord does not cure the increase, then the tenant may terminate the rental agreement at any time prior to the effective date of the increase by providing the landlord with written notice at least 20 days before terminating the rental agreement.

The tenant will owe rent for the full month in which the tenants vacate the dwelling unit. A landlord may not charge a tenant any fines or fees for terminating a rental agreement.

The landlord may not charge a tenant more than a 5% difference in rent depending on the type of lease or rental agreement offered.

If the court finds the landlord in violation, the court shall award the following:

- Damages in the amount of any excess rent, fees, or other costs paid by the tenant.

- Damages in an amount of up to three months of any unlawful rent, fees, or other costs charged by the landlord.

- Reasonable attorneys' fees and costs incurred in bringing the action.

- Civil penalties of not more than $7,500 for each violation.

A landlord may not report the tenant to a tenant screening service provider for failure to pay the portion of the tenant's rent that was unlawfully increased in violation of this section.

Landlord is exempt if:

- A tenancy in a dwelling unit for which the first certificate of occupancy was issued 12 or less years before the date of the notice of the rent increase.

- A tenancy in a dwelling unit owned by a:

- (i) Public housing authority.

- (ii) Public development authority.

- (iii) Nonprofit organization, where maximum rents are regulated by other laws or local, state, or federal affordable housing program requirements; or

- (iv) Nonprofit entity, where a nonprofit organization, housing authority, or public development authority has the majority decision-making power on behalf of the general partner, and where maximum rents are regulated by other laws or local, state, or federal affordable housing program requirements.

- A tenancy in a qualified low-income housing development.

- A tenancy in a qualified low-income housing development which was allocated federal low-income housing tax credits.

- A tenancy in a dwelling unit in which the tenant shares a bathroom or kitchen with the owner who maintains a principal residence at the residential real property.

- A tenancy in a single-family owner-occupied residence, including a residence in which the owner-occupant rents or leases no more than two units or bedrooms including, but not limited to, an attached or detached accessory dwelling unit.

- A tenancy in a duplex, triplex, or fourplex in which the owner occupied one of the units as the owner's principal place of residence at the beginning of the tenancy, so long as the owner continues the occupancy.

Exemptions do not apply if the owner is a:

- Real estate investment trust

- A corporation

- A limited liability company in which at least one member is a corporation.

Upcoming report specific for those in Bellingham, WA.

The above is meant to be a quick summary of what is now Washington State law.

We will be doing further analysis of what the economic impact will be to our community.

It will provide you with our unique perspective using historical data for what could happen in the upcoming years for both residents and rental owners. This will be a must read for anyone living or owning in Bellingham.

We hope to bring the report to you soon!