A follow-up opinion article to the summary of House Bill 1217, aka statewide rent control.

Emphasis on opinion. I’m not an economist, nor do I proclaim to be. This is for entertainment purposes only, as I get joy from theorizing about the impact of economic policies that will affect renters, rental owners, and homeowners.

Summary of what has transpired in the past few weeks. The State of Washington has passed a bill that caps the amount of rent that can be raised on an existing resident. Washington’s Department of Commerce will set the rent cap to either 7% plus market price index (CPI) or 10%, whichever is lower.

Downstream effects will be extensive, and everlasting. It will create short-term stability and predictability.

However, it sacrifices the resident and landlord in the end.

This bill marks the death to legacy residents. We’ve kicked the snowball of disincentivized rental ownership down a slippery slope. The cost of housing has the potential to rise at an unprecedented rate.

I’ll talk about the reasoning behind House Bill 1217, and its goals. Then, describe the factors at play for the rise in rent. Followed by both the short-term and long-term impacts we could see from the recent law.

Why House Bill 1217?

I’ll acknowledge the goal of the bill is to increase the amount of discretionary income residents have at the end of the month by limiting the cost of housing.

In theory, this bill will provide a predictable and consistent forecast for residents. Theoretically resulting in expenses reduced, savings/spending increased – yay!

Washington is a desirable place to live. We have a favorable climate, magnificent geography, and unmatched outdoor recreation. Not to mention, favorable income tax laws. This area appeals to the youth, and the elderly.

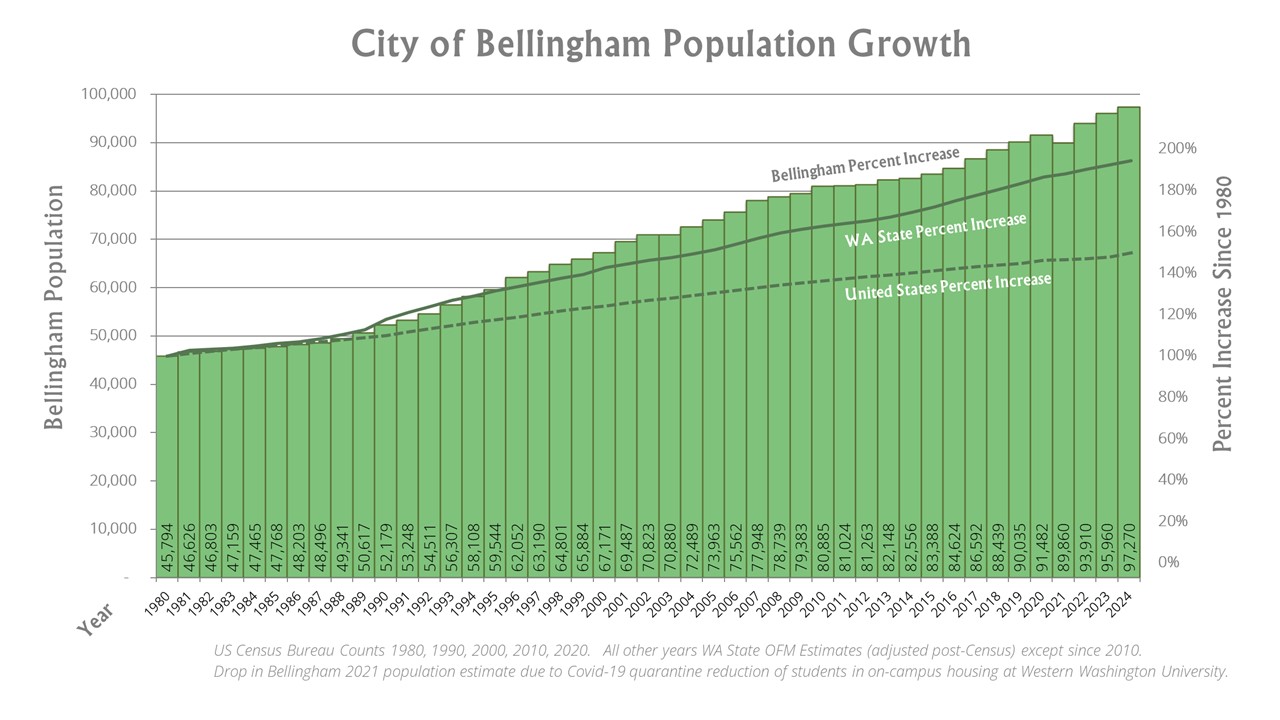

The demand for housing due to consistent population growth causes a strain in the supply. Partially contributing to what we are feeling – rental pricing increase.

I’d like to think most understand the basic supply/demand relationship, but there are a few other factors at play which we’ll get into.

Our legislature feels, hears and sees it from the public. This has been going on for as long as I can remember. And, if I were a betting man, ever since the 70’s.

Senator Alvardo spoke with Non-Stop Local Reporter, Davis Raile and summarized what Olympia is seeing, “People are getting crushed by rent increases. Rent is the single greatest cost in a household budget.”

However, the bill acts as a Band-Aid for an economic infection that will continue to fester. It’s not until we treat the infection, will we see the impact we desire.

What is Causing the Rise in Rent?

Rent doesn’t naturally rise simply due to being rent. There is a cause and affect relationship at play here. The issue is the number of causes is vast. All which contribute in some degree to the increase in rent overtime.

For the sake of the article, I’ll keep each reason brief. We will expand and elaborate upon each reason at a later date.

Population Growth

The most simplistic aspect to grasp. As mentioned earlier: more people equal higher demand, supply doesn’t meet demand, then supply gets more expensive.

Geographical Restrictions

Areas such as Phoenix, Las Vegas, Dallas, and Denver have unlimited geographical areas to build. The surrounding area is flat and unobstructed, creating endless building opportunities for new construction.

On the contrary, using Bellingham as an example. There is only one direction that can be developed – north. If you build to the west, then you’ll end up in Bellingham Bay. Go east, and you’re in Lake Whatcom. Or south, it is blocked by Larrabee State Park.

Like Bellingham, most areas in Western Washington experience this to some extent.

Lack of Desirable Property

We’re not seeing a new supply created to match the qualitative demand of what the populous desires.

Taking Bellingham as an example, of all the development in the area, there is only one major single-family home development. All other developments are comprised of large apartment buildings.

More nuanced, people desire uniqueness in a home.

Modern single-family developments all have the same layout, design, finishes, etc. It is rinsed and repeated – over and over.

Increased Cost to Build

Builders must be incentivized to produce new developments at a profit. If they can make more in a shorter time elsewhere, then that is what they’ll do.

The cost of materials and labor in the construction space has drastically climbed.

We’re seeing a 6.5% increase year-over-year in the cost of building.

.png)

Increased Cost to Purchase Rentals

It is obvious the cost to purchase a home has climbed exponentially. The more hidden costs not discussed are debt service (mortgage), homeowner’s insurance and property taxes.

Rarely is a new rental purchased in all cash in Bellingham. Instead, debt needs to be taken out in order complete the transaction. For a $750,000 purchase with 20% down at 7% interest rate; the monthly payment is $4,000 for a home that you may rent for $3,700.

In addition, homeowner’s insurance rates have increased on average by 24% from 2021 to 2024. Roughly costing owner’s $134 per month for coverage depending on the property.

Tack on property taxes for roughly $450 per month, on average.

Not taking into consideration the repairs and maintenance… Purchasing a generic new rental would run you roughly $4,584 per month in principle, interest, taxes and insurance. However, it may only yield $3,700 in gross rent per month.

I’m no math whizz, but math isn’t mathing.

Increased Cost to Maintain

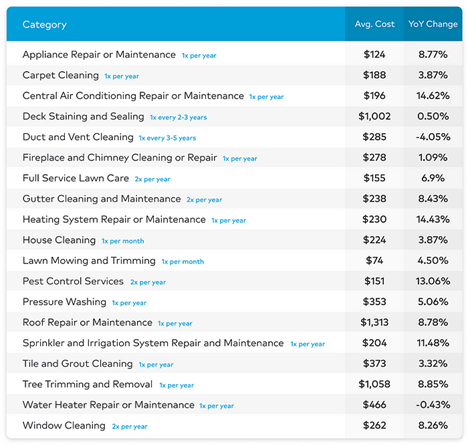

Similar to the cost of building new properties, the cost to maintain an existing rental has skyrocketed.

Studies made for the Home Care Price Index, reflect an all-time high of $10,433 per year going towards properly maintaining a home’s condition.

Here are a few helpful graphics from their study:

Additional Legal Risk

We’re seeing Owners sell off their rental properties, because they believe the possibility of renting to a resident that won’t pay or damage the property is not worth the financial risk.

They are seeking flexibility to maneuver if they ever get into that situation. The flexibility has rapidly eroded away since the 2020 eviction moratorium.

This is a topic for a different post. However, it can’t be discounted that we are losing rental supply from Owners exiting the market.

Short-Term Impact (1 – 5 Year Period)

The WA State Department of Commerce’s annual publication of maximum allowable increases (starting June 1, 2025) will provide renters with greater predictability in the short-term.

The bill authorizes the Attorney General to enforce compliance, with penalties up to $7,500 per violation, and allows residents to seek damages for unlawful rent increases.

There will be an initial reduction in rental housing supply. As developers find Washington less attractive due to restricted revenue potential.

Small rental owners will face challenges covering rising maintenance costs, property taxes, and insurance premiums, which could lead some to sell properties or convert rentals to other uses, reducing available rental units.

Long-Term Impact (6+ Year Period)

The stories we hear of residents staying in a home for 15 years with minimal increases resulting in rent being 30% - 60% below market will soon become a rarity.

Rental owners have been able to do such a thing, because of the flexibility of rent increases.

Knowing they had the ability to increase it with no limit meant they could keep rents low and ride the tenancy for as long as possible with limited increases.

As the cost to maintain a home continues to climb with no cap. Rental owners will begin to feel the squeeze of having to put money into a property without seeing a return.

The small, but mighty investor may not have the discretionary income to front capital for projects knowing they won’t be able to get it back any time soon.

Potential rental owners will choose elsewhere to invest their money. Or simply decide not to invest at all. They’ll see the uncertainty of being able to increase income to match expenses and decide to go a different way.

Like the point made in the short-term impact section. We’ll continue to see a reduced number of built-to-rent homes in the area.

Resulting in a reduction of supply to the rental market.

There will be an increase in legislative action to attempt to cure ramifications from this bill.

We’re likely to see an outlawing of no cause non-renewals. There will be a surge of rental owners who choose not to renew leases to market the property for a higher rental amount, because they can’t increase the rent on an existing resident to maintain margins with raising costs.

Resulting in Olympia taking more legislative action to attempt at curing a lagging result for an action created potentially years ago.

This is something we’ll be monitoring closely.

Ultimately…

There will be reduced investment in local markets.

All the above have resulted in a reduction in investment dollars. Speaking specifically about the Bellingham area, it is my belief that we’ll continue to see a reduction in investment dollars on Main St. Resulting in more money going to Wall St.

First, the ratio between the number of available single-family rental homes, and the number of residents seeking single-family rentals will continue to widen.

Second, upkeep of rental properties will begin to decline.

Unfortunately, if this comes to fruition, then we will see single-family rental housing begin to climb in price exponentially while the quality of product degrades.

Resulting in a situation of “costing more for less” situation.

The leading question is, how long do we have before seeing these adverse results?

SOURCES

https://maps.cob.org/resources/images/pcd/HousingStatsStoryMap/PopulationGrowthSince1980.jpg

https://www.rlb.com/americas/insight/rlb-construction-cost-report-north-america-q2-2024/

https://www.cnbc.com/select/homeowners-insurance-has-skyrocketed-over-50percent-in-these-states/

https://www.bankrate.com/homeownership/most-common-home-maintenance-costs/